Accepting one’s own mortality is a tough pill to swallow. As such, estate planning can be a morbid topic that lingers in the background of our lives ominously

History has demonstrated reversion to the mean. **JB**

A recession is inevitable, according to Joe Zidle, of Richard Bernstein Advisors, as the yield curve

Another data point that Advisors should be having downside risk conversations with their clients. **JB**

- The spread between bulls and bears hasn't been this

Many Financial Advisors are looked to by their clients to explain market conditions. Here is a slideshare that may be useful to distill into a high level

Note the insightful comment on checking out from "Hotel Easy Money". **JB**

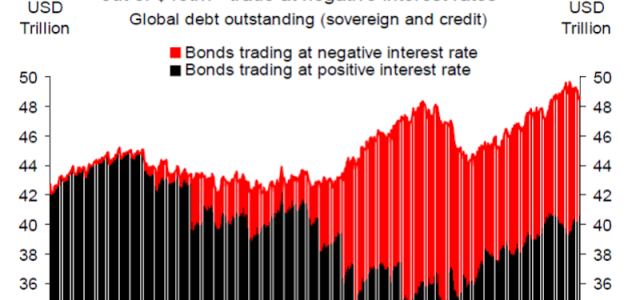

For all the hype about bitcoin, far more investors are exposed to an $8 trillion

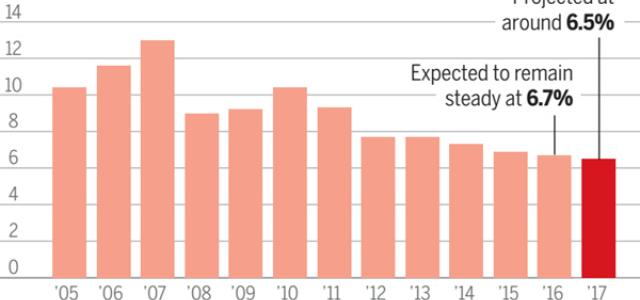

China's growth numbers came in essentially as expected with fixed government investment being pulled back, offset by stronger retail and business investment -

Professor Thaler 's prestigious award aligns with our experiences with investors. We deliver disciplined, endowment-style investment strategies precisely

Optimal Capital's CIO Jay Batcha provides insights in ETF.com

There’s a bull in the bond market—and it’s bad for investors.

At least, it’s bad for investors

This is the best analysis I've read on validity and usefulness of CAPE **JB**

Sep 21, 2017 ROBERT J. SHILLER

The US stock market today looks a lot like it

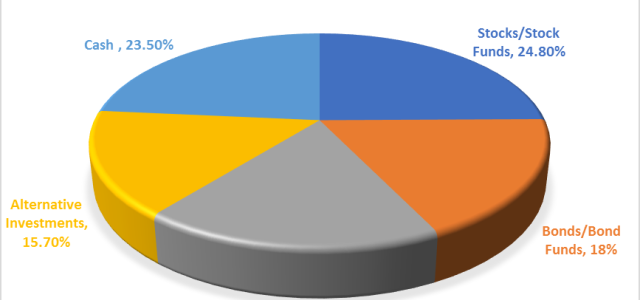

Endowment-style investing is what we do - here's another data point on why it's differentiating for smart Advisors. **JB**

If the saying, “the rich get richer

Optimal Capital's CIO Jay Batcha provides insights in Barron’s

Barron’s ETF Special Report

Active or Passive? Why You Should Use Both

For an optimal portfolio