Are You Investing Like the One Percent?

Endowment-style investing is what we do - here's another data point on why it's differentiating for smart Advisors. **JB**

If the saying, “the rich get richer,” holds any truth, there is probably a reason for that. As wealth increases, so can access to information and new opportunities. This is especially true in the world of investing where access to certain managers or investment opportunities is often off-limits to average investors either due to manager-imposed minimums or financial industry regulations.

As investment managers launch funds, those who are successful will often increase the required minimum investment as their fund grows. Over time, it becomes less and less feasible for an individual to access those investment strategies where minimum investments can be higher than $1 million. The average investor is then left only with the option to purchase mutual funds or individual securities.

In addition to manager-imposed minimums, there are several financial industry regulations that prevent many investors from accessing certain types of investment opportunities. For example, many hedge funds and private equity opportunities employed by high net worth investors, pensions, endowments, and other large investors are only open to accredited investors under Securities and Exchange Commission regulations. An accredited investor is defined as someone whose earned income exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, OR an individual who has a net worth over $1 million excluding the value of the individual’s primary residence.

Broadening Your Investment Reach

If you don’t have $1 million to invest, you can still create an investment portfolio that looks more like that of a high-net-worth investor, pension, or endowment. The key is accessing non-traditional investments other than stocks and bonds and owning them in an appropriate proportion that makes sense for your individual circumstances and goals.

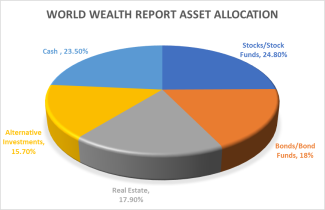

According to the 2017 Capgemini World Wealth Report, here is the asset allocation of the average high-net-worth investor in North America (see pie chart above).

Click here for free access to 100's of articles for your clients

According to a February 2017 report from the American Association of Individual Investors (AAII) Asset Allocation Survey, individual investors are still relying primarily on a traditional stock and bond portfolio:

- 35% stock funds

- 31% stocks

- 18% cash

- 13% bond funds

- 3% bonds

Incorporating New Asset Classes in Your Portfolio

While there is never a one-size-fits-all solution for investing, there are plenty of ways to make sure you are taking advantage of all opportunities available to you within the framework of your long-term goals and overall financial situation. Talking to your financial advisor is the first step.

contributed by John Eubanks, CFP®, CDFA™ - Partner, Wealth Management at Patton Albertson & Miller